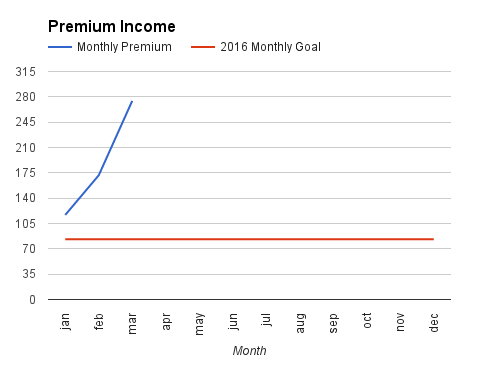

Having play money is a luxury. I do realize that. Having play money that pays you each month is something I thought not possible. And yet, the combination of dividends and option premiums make this play money an actual source of income.At the start of 2016, I set the goal at 83,33/month or 1000€ for the whole year of 2016. January was great, February was awesome and March is Kickass.

Due to the volatility and moves in the stock market, I was able to write and close far more options than ever: 13 positions in total contributed the result. GDX was by far the biggest with 5 trades and 150 USD in premium. XLE a good second with 46 USD.

The total premium income is 274,5 EUR

To me, this just sounds kickass wonderful. It beats by far my own expectations. Given my monthly goal of 83,33 it is actually 3,3 times my goal!

Time to stop working?

Not even close to that. There are actually traders and bloggers out there that make 5 time or more the monthly income that I make. Kudos to them. Both feed on the ground for me.

I have set my personal limits, I breach them once in a while each month. So, that is clearly an attention point. I agreed with myself a maximum value of open put positions. I have a hard time keeping my limit. It is not that I double it, I reach 180pct of it. That is clearly an attention point

I might be on a winning streak now, but I am very much aware of the potential loosing streak that might hit me some day. I do not mind rolling trades. This will slow me down as far as getting premium goes. What will really kills me is getting assigned stock above the level of my limit.

March for me is a fat tail month. It would surprise me to reach it again this year. February seems to be more the norm to me. As I am only 3 months into real option trading, it is too soon to say. Lets wait the year end for conclusions.

Dividend income

March is a month that my oil stock pays me. I got 77,01€ paid into my account. This is after all imaginable taxes… There are a lot! There were no trading gains this month

The Q1 result from the trading money is 749,14€

How was your March month and the Q12016?

I love your descriptions for the month!

Great to see you above the goal line so early in the year.

LikeLike

Glad you like it. The description is how i feel today about the past months

LikeLiked by 2 people

Congrats on a ‘kickass’ month, AT. Great to see that you are having a great month after month this year. Keep up the great work and thanks for sharing

R2R

LikeLiked by 1 person

Congrats on some great options income. You are absolutely right to be reserved about your winning streak. Jim Rogers, an investor I enjoy reading, has gone to great length to explain the most dangerous time for any investor is once they’ve made a little money. I remember sevreal years ago, I became overconfident as the result of a very profitable trade, and reached for the next one. Fortunately, Mr. Market has a way of reminding us each of our own limitations. Good job keeping your emotions in check. I hope the week ahead is a great one!

-Bryan

LikeLike

There are many ideas and tweaks in my head on how to earn more. For now, my rational side still blocks those plans! I am preparing for Mr Market to hit me when Ieast expect it.

LikeLiked by 1 person

hey amber tree!

it is such a great honor for me, that you put a link to my site! thank you very much!

275 Dollar Premium is very impressive! How much play money do you have in your account? You dont have to answer this, if you dont want to. I will understand 🙂

best regards

LikeLike

It is natural to mention you. I read your blog and your system is profitable as well.

On sharing the numbers: that is harder for me… what i can share: My peak open put value is around 26k euro. That is where i try to limit myself. I have a feeling it goes up each month.

LikeLiked by 1 person

Hey Amber, that’s a really nice amount of passive income you made this month. Nice job!

Tristan

LikeLike

Wow, pretty good additional income with your play money. Glad to read that you try to keep your feet firmly planted on the ground. But at the same time, keep going, you are doing really well.

LikeLike

thx for the support. keeping my feet firmly planned will be the challenge the next months. In the mean time, I enjoy the results

On the running challenge: I have to plan a MRI scan of the knee…

LikeLike

Oh crap, that is not good news. Good luck! I was able to do the first run in about 3 weeks last night (it has been busy), 4.1km in just under 22 min, bit of a step backwards from the previous high…need to “step” it up (sorry for the bad pun).

On a side note, you can always take up swimming to maintain your exercise/fitness level, very low impact on the joints.

LikeLike

I went to the fitness on a cross trainer a few times. I did not hurt during or after the workout. I might keep that as a cardio solution for now.

LikeLike

That looks pretty impressive to me! Keep up that good work.

LikeLike

Solid stuff ambertreeleaves. That’s money working hard for you so you don’t need to. Keep up the great work.

LikeLike

Great returns, ATL! Nicely done.

LikeLike

This is a really nice progress. For Q1 only, you’re just a hair short of your annual goal.

Would there be an unreasonable amount of risk to raising your yearly goal to 4000 EUR?

You need something more challenging than a goal you’ll reach in the next quarter 😉

LikeLike

I will indeed need to change my goal. At the same time, I want to stay realistic and stay away from too much risk.

In order to earn more, I could place more trades. This sounds doable. I kinda happens automatically as my account grows. I have a tendency to consume all my margin.

I could also take more risk per trade, be more aggressive with my strike selection. This is not something I plan to do.

For this year, I have more a sit back and see what happens approach.

LikeLike

Awesome results so far! don’t try to beat your previous month all the time and you will be on a very good year!

Congrats!

Mike

LikeLike

thx for the support. My goal is to stick to the plan each month. I will see where I end up.

LikeLike

Congrats on a great investing month!

We are just starting to invest in taxable investments and can’t wait to start seeing some returns.

LikeLike

thx for stopping by. Good that you started. Any goals you have in mind?

LikeLike

Hmm not sure yet, ideally I would invest what’s left over from the budget, my annual bonus and my husbands extra jobs. Right now , we want to throw extra money at the mortgage, 529 plans and taxable investments so it’s a balancing act we are still trying to figure out.

LikeLike

Excellent progress Amber Tree!

I like how you chart your progress. Will be looking into doing that myself soon too. Keep up the good work 🙂

LikeLike

Thx for stopping by! I look forward to reading your option stories.

LikeLike

You are doing the right things that’s for sure. It’s always fun to tally up a month’s worth of passive income. Nice dividends nice premiums too. Seems like more and more dividend bloggers are getting into options trading. Congrats on a great month. Thanks for sharing.

LikeLike

Great Job! I like your concept of play money as well. Keep up the great blogging I enjoy your posts.

LikeLike

Wow. That`s pretty sweet. Passive income is the way to go!! Congrats on your success.

LikeLike

Congrats on an awesome month! March is my best month as well…year to date.

It seems to me that income from options investing is not as passive as dividend income. So, it is very nice that you are able to balance it and get income out of both. What percentage of money do you put in each bucket? For the conservative me, the odds of a misstep are higher in options investing (greater reward also perhaps) w.r.t. dividend investing…I am curious how you balance the two buckets…

Congrats once again!

LikeLike

My options bucket is in my play money. That is a very small part of my portfolio. Less than 10pct.

I only write put options on stock I do not mind owning. In that sense, the risk is acceptable for me. Worst case, I would need to buy the stock.

LikeLike

Hey ATL. Thanks for sharing and keep it up. You sound like your enjoying this very much and I’m happy for your progress. This journey is awesome and there is no feeling like receiving dividends. It’s awesome. I promise you! Cheers bud.

LikeLike

Thx for stopping at my blog. Getting paid out of the market/companies you own is indeed a great feeling…kinda addicting

LikeLike