While life happens, your portfolio builds up. Having a look at this pile of assets from time to time does not hurt. Being a spreadsheet nerd, I can now easily follow all of this via custom build tool. So, let’s see where we are…

Prior to a review, you need to know how to score, you need a set of criteria. As mentioned before, our portfolio is there to support our life goals, it is not a goal on itself.

How can our portfolio contribute to these life goals?

Here are the items I expect from my portfolio:

- Sleep well at night: life is at it’s best when you are well rested and full of energy. Reducing stress and having a good night of sleep is essential to that. Hence, it is important to feel comfortable with your portfolio.

- Ring fence my need for speed: As I always want to try out new things, explore other investments, I need to make sure that this does not screw up my portfolio.

- Grow our wealth so we can remove money out of the decision process. This is key. It does not have to mean be FI, it means: feel comfortable when you make a decision, as you know that the portfolio is there to cover a potential financial crisis. Once this point is reached, you can grow up to FI and beyond!

The portfolio

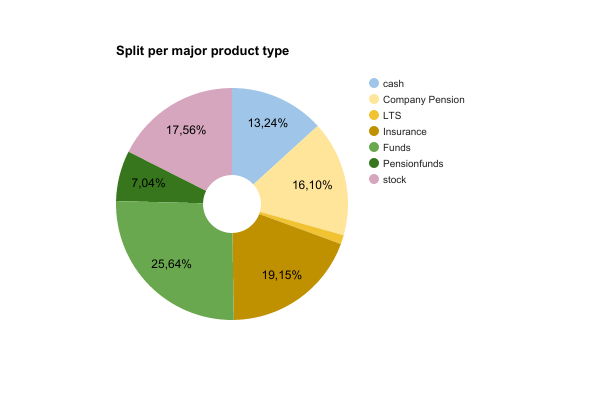

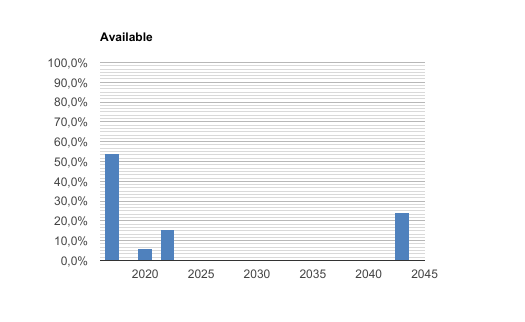

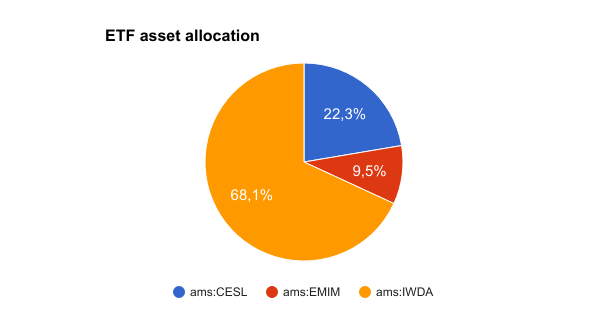

With 3 simple graphs, I will analyse my portfolio to the 3 criteria above.

Essential details on the portfolio categories

- Cash: simple: EUR and USD we own.

- Company pension: in essence, this is what we have saved in a company pension plan. Some is our contribution, a lot is the contribution from our employers. Unlike a 401K, we have no impact at all on where it is invested. In our case, it is all invested in a sort of capital guaranteed accounts with a minimum guaranteed return (between 3,75 and 1,75 pct). There might be a little bonus return when the underlying (bond) portfolio does really well…

- LTS: this is fiscal long term saving. It is by law required to invest this in a similar product a the company pension. That is why I stopped doing this for 2017.

- Insurance products: this is again a product similar to the 2 above. These insurance products over time will replace our emergency funds. In a few years time, they actually vest and the we can withdraw money penalty free!

- Funds: these are actively managed funds that I own. NO further comment, yell when you feel the need!

- Pension funds: actively managed funds in a Belgian fiscal account. This is the best one can do with the money that is put in those type of accounts.

- stock: these are all our trackers and individual stocks.

- Not listed: crowdfunding investments… They would appear only at the size of a pixel in the graph.

Does this look diverse enough to qualify for Polyinvestmentamorous?

Roughly half of our investments can be sold now for whatever reason we need it. The big spike in 2043 is when we reach the legal Belgian pension age. The 2 smaller blocks are insurance products.

The current allocation is really close to my target allocation. Boring, as ETF investing is supposed to be!

Sleep well at night: given that our portfolio has a lot of guaranteed assets (the yellow, brownish part) this is a goal that is achieved. The percentages of the portfolio do not matter to me. What matters is the EURs they represent! Here, all is good. That also means there will be no after tax contributions anymore. Off course, we will not ask our employers to stop contributing…

Ring fence my need for speed: let the cash in the portfolio not fool you. Almost all of this cash has been deployed since the options experiment started. The cash is now working for me as cash margin for put options. That is good as well.

grow our wealth: As you can see, the portfolio is really low on pure stock investments. This is the current downside to our portfolio. When I count stock and options money, we only have 30pct. When I add to that the funds (the guesstimated stock part) , we reach about 45 pct. I would rate this as meuh, quite low!

How is your portfolio helping you?

Wow, and I thought that we were well diversified! This us quite the spread. Interesting too how big you pension/insurance portion is in relation to your stocks and cash/options trading.

I see why you sleep well at night.

LikeLike

When i see the return, i want to cry…!

LikeLike

That feeling I can understand!

LikeLike

I didn’t know that about the company pensions over there, too bad you don’t have control to invest where you want. It is your money after all! Probably all the more important to have funds outside if that in stocks like you do. Good diversification! Thanks for sharing.

LikeLike

Looks like a solid type of portfolio. As long as it makes you feel safe, it is good. I think the % might vary a lot depending on the character of the investor, but everyone should decide for themselves what suits best.

My portfolio breakdown:

note: I have cash available for investments but some is reserved for options. It’s hard to separate this but I’ll try to be as exact as possible.

– 5% cash (actually higher but, options, you know)

– 7% bonds: once they reach the end date, this will be put into stocks/etfs.

– 3% pension fund: stopped this one, just letting it run. Might try to fix an arrangement for this.

– 2% home invest plan: for the mortgage on a house later. (stupid decision from my dad…)

– 83% stocks of which around 3% etfs. I should hold more etfs, I know.

LikeLike

Good post. Since I don’t have the luxury of guaranteed income like pension, my SWAN can on,y be self-created. I take my diversified dividend portfolio where no company contributes more than 6% of dividend income as my substitute for SWAN.

LikeLike

Very nice job explaining how you manage your financials. Not many people can explain their situation the way you can. Have you considered an alternative that is further distanced from the stock market. We purchased a couple of rental properties six years ago and paid them off (no mortgage). Carrying a mortgage helps with taxes but I preferred the cash flow. If the stock market were to cause a significant problem the rental income provides over 1/3 of our monthly cash flow needs. When I don’t need the rental income it builds up. Twice a year I can withdraw our monthly cash requirements from the rental account and leave the stock account alone. The properties have also appreciated (Boston real estate market has been strong) significantly in addition to the cash flow generated.

LikeLike