When you plan to become Financially independent, you need a plan. Our plan is simple: life below our means and invest the rest. These monthly Amber index posts provide a follow up of the plan. I check if we are on track for FIRE in 2029.

savings rate

From the graph above, it surly looks we are on track. Both YTD savings rates are above their target. The past 2 months, we were below target. This is a similar pattern from last year. Next to our monthly automated saving, we depend a lot on uneven distributed events like tax refunds and bonuses. The timing of these is unpredictable. This are the items that will create the occasional peak like they did in January. More to come later this year.

Does this means we have no fun? We have tons of fun. Not all fun costs money. And we both have fun money we can use on discretionary spending. Just like we did lately. We took the kids to the K3 shows (worldfamous in Flandres an Holland, a lot less outside this area). After the show, there was priceless fun on the beach with first toe dip. We have brave kids, the outside temperature was ony 11°Celcius. I kept my feet dry.

Does this means we have no fun? We have tons of fun. Not all fun costs money. And we both have fun money we can use on discretionary spending. Just like we did lately. We took the kids to the K3 shows (worldfamous in Flandres an Holland, a lot less outside this area). After the show, there was priceless fun on the beach with first toe dip. We have brave kids, the outside temperature was ony 11°Celcius. I kept my feet dry.

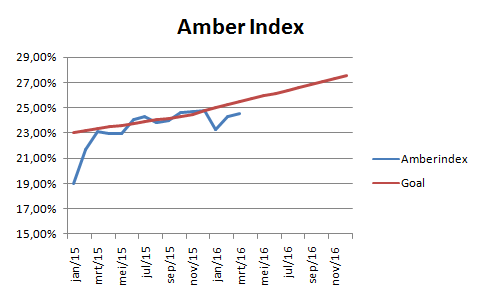

Amber Index

This index tracks the overall progress towards the 2029 FIRE goal. What do you see?

Progress is not looking good. We are approx 1pct below target. So what? Well as the 4pct SWR is the basis behind the index, 1 pct represents about 3 months of expenses ( that is 1 pct of 300 time your expenses). And that is quite a lot to me. Do we panic? not yet!

- We have reached the point where the markets decide if we go up or down. Our monthly investments are needed but do not decide on the final outcome. The contributions are still there (see the SR above) According to the plan, we need a decent market return. The past 4 months, we have not seen these returns. That explains one part.

- The goal line also assumes that the money inflow is evenly. We know this is not the case. We still expect some extra cash to invest later this year. This should give a boost.

- Some holdings we have only provide a yearly update of their value. I am too lazy to calculate pro rata what they would be worth now.

All in all, we do not need to worry now. There will always be blips in the graph. This is just a blip en cours du route.. It is the overall trend that matters most. The trend is positive, so am I!

How is your progress?

Ciao Atl,

It seems to me that you are pretty much on track, -1% is nothing, if it was -5 or -10 I’d be more worried, but fortunately it’s not your scenario… 🙂

I also struggle to make it above “break even”, but the last 8 months saw 2 major crashes and a lot of volatility, so I am not too worried about it right now…

Ciao ciao

Stal

LikeLiked by 1 person

Hey stal, the markets do not help right now. A lot depends on the timing of the report. For now, we do not worry.

LikeLiked by 1 person

Well, the savings rate looks good and your focused so it’ll be allright!

What’s the difference between full and revised? Did you explain that in some posting?

LikeLike

The difference is in some post. I short: the full assumes that the mortgage is a saving as well. The revised only counts money that actually goes in an investing account.

LikeLiked by 1 person

Wow! Things are under control. That is a situation that I look forward to myself. But first moving back to The Netherlands and establishing a suitable longer-term home….

LikeLiked by 1 person

Nice work AT. It looks like you’re striking the right balance with the family, between work and play, while making great progress to your future goals. Have a great week!

-Bryan

LikeLike

thx for the support. I am happy with the balance we find as a family

LikeLike

I like the KPI’s you’ve developed to monitor your progress. I like your focus on the things you can control (savings rate). Investment returns are a MUCH longer metric, and you’re correct in not over-reacting to short term volatility. Having said that, a metric on your Asset Allocation would be an interesting chart to add to your scorecard. Nice work! Keep the focus!

LikeLike

Thx for dropping by. The highe level asset allocation could be added easily… Going in full details might be more difficult. This has to do with my mutual funds – I know… 😉

I might add the split per fund type/source

LikeLike

Your absolutely right, just stay the course and it will all work our just fine.

As for the savings rate, do you guys also have the May holiday allowance?? In the Netherlands, this usually is the time a 8% of your salary payout shows up on the bank account….

LikeLike

Yeps, in May we get also a holiday allowance. Last year, it spiked the savings rate. This year, it will sink the savings rate as the money goes to the travel fund. And that fund is not counted as saving…! bummer.

LikeLiked by 1 person

A well, so be it, but that Travel Fund is very important, so sacrificing the savings rate for a months is not a big deal. Already any specific plans for the fund for this year (or the next)?

LikeLiked by 1 person

The plan is to stay local this summer and do a ski trip next winter season.

The bigger plan is new York or Canada in 6 years. And then a trip like that each 2 years.

LikeLiked by 1 person

Nice plan, can definitely recommend both NYC and Canada. Great place/country to visit. If you want some tips, please do let us know.

LikeLike

On Canada, I could you some tips. I will reach outwhen we plan to go thare. Might be still another 4-6 years 😦

LikeLike

Please do that, even that far in the future 😉

LikeLiked by 1 person

Things are looking good, AT. Like others said above, 1% off the target isnt too much to be worried about…looks like you are well on target to get to your goals.

Keep up the great work and thanks for sharing

R2R

LikeLike

Hey ATL, everything will turn out good in the end. Just remember, the more your investment/index drops the better it is to invest at the point, so you get more bang for your buck!

You are doing good 🙂

Tristan

LikeLike

Thx for the support. We are in it for the long term

LikeLike

Nice work! How long ago did the markets start dictating your success vs your actual contributions? (Markets will always control, but obviously at a smaller rate when your balance is lower)

Do you have any advice for people that are approaching that amount of savings (especially losing “control”)?

LikeLike

For me, I consider that the market is in control if in a given month my savings are less than the market loss. It happened already a few times to me, so, I consider now have reached the point that Mr. Market is the boss.

Advice I would give: Enjoy it. It means that you have substantial nest egg. At first I was not happy when I saw a drop. There is only one thing you can do: keep an eye on your asset allocation: Are you happy with the potential max drawdown in a serious bear market. It will happen. Just the when is uncertain.

LikeLike

Your kids are brave indeed — getting even their toes wet at 11 degrees C! I think you’re right not to be too concerned. As you said, the markets are in charge now, and they tend to go up long-term. Plus your funds that only update at the end of the year plus other bonuses you’ll get will make a difference. We always go into the end of the year concerned that we won’t meat our goals… and yet every year so far we’ve exceeded them after the bonuses came around.

LikeLiked by 1 person

In the end it all will be fine. Like you said, there are bonus elements to boost. I look forward to these. One will be booked in April.

LikeLiked by 1 person

Nice Work! The Amber tracking is interesting and it is nice to see the target vs actual month by month.

For any cases that happen irregularly, like big windfalls, is there a way you can discount them in prior years to get a more accurate measure on year over year progress? So, if you had a big check come in during March 2015 for 5 Million dollars (thinking big here), then on March 2016, you wouldn’t factor in last years savings rate without the 5M check.

Our savings rate has been somewhat steady at improving each year. Thanks for posting your rate and keep up the great work!

LikeLike

I see where you want to go with tracking the irregularities. Until now, most irregularities have been there each year, it is the amount that fluctuates slightly. As we automate our savings and investing and pay ourselves first, the actual core saving is stable across the years.

LikeLike

Hello AT,

wow! congrats on your saving rate! You are doing great! I’ve quit on trying to keep a high saving rate, it seems that I just can’t make it. However, I’ve been able to stabilize my budget for the past 2 years and expenses are slowly going down. The only thing left now is to crank-up revenues 🙂

LikeLike

That sounds like you are doing well. We also started with a stabilizing the budget about 10 years ago. Any salary increases were saved up.

LikeLike