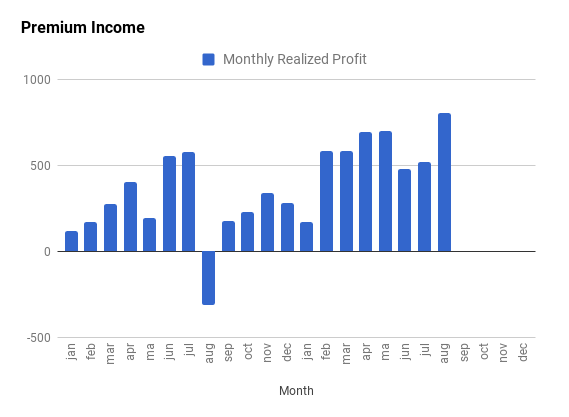

With August behind us, I can write up a new post on my option trading income. And what a month it was: A new record combined with a few bad market events that created the elephants in the room. Can you help me with my elephants?

Option Income – 805.95€

It is official: you can make money while being on Holiday. In August, we were off 2 Weeks to Croatia. And still, I had trading income of 805€. That amazes me.

My current annualised return is 13,66%. That is way above the return that I use to calculate my FIRE date.

As from now, that should be my benchmark: Do I beat the market returns in my FIRE calculator?

The income is from 14 different stock. The main contributor this month was RDS.A. After being called away and missing out on the dividend, I already compensated more than the yearly dividend.

After my post on greed, I decided to take more emotions out of the game and now take the habit to take my profits soon. Actually, this is nice. At random moments, I get a trade confirmation and that means a profit! How do I do this? I create a Buy-to-Close trade after opening the position. Especially for the more speculative trades or trades that I regret. And it works. Just this Friday, the mechanism closed a trade that was open 2 days. The trade was a “mistake” as I forgot to check the earnings . Either way, I have an annual return of 95pct (The annual returns on a single trade are just awesome. They are perfect to show off and be the king of the world. In reality, we talk 20USD…!)

Dividend Income – 106,92€

August saw a paid dividend income after tax and fees of 106,92€. The vast majority comes from 1 stock. It actually has a 50% gain in 14 months. Should I sell? Or just forget about it? It is reasonable to expect that this dividend will increase year after year.

The elephants in the option portfolio

This is a new section. It’s goal is to give you an i sight in the problems that come with options portfolios. I plan to expose to you my fears, doubts and bad trades and how I think this will affect my income.

Why would I want to do that? I think it is very important that I do not only share the great results. It is even more important to share failures so that we can all learn from these.

Elephant 1 – TEVA

This is a big one: rather a herd of elephants.

The stock had been range bound for about 4 months already. That looked like a good option trading opportunity. Sadly, the earning were no bad, they were over-the-top bad. Cutting the dividend, closing factories, negative outlook on sales price of the products,… The stock dropped hard right after. I defended the position by rolling and thought I would be fine. Sadly, the drop is not over yet.

I consider taking a partial loss by rolling down the strike and taking the debit I pay as a loss.

Would I take into account the loss from this trade, there would still be an annualised return of 9,9 pct.

This will be a few years of drag on my returns. This one makes me sleep less good. Time for action?

Elephant 2 – LB

Similar story, not so bad. The stock seems to have stabilised sooner. and by rolling it out to January, the position is actually ATM. It does not mean it is profitable. This cash used to secure this put will not produce returns the next 4 months.

Elephant 3 – (non disclosed)

I overplayed a little here, by opening a postion too soon and not closing for a profit the other one. My bad!

Elephant 4 – AMS:AD

Thank you Amazon. You have send this one down from 19 to 15 and I am rolling, rolling rolling. Trading fees here are high compared to the time value. This is no fun situation. Should I take assignment for the dividend?

Total Pct ITM 46,77pct.

Given the elephants and the ITM percentage the outlook for September is not good.It means rolling a lot of trades and not booking profits in September. On the other hand, it creates high income months like August: after rolling RDS.A, I was able to book a big nice profit in August.

As I plan to reduce the size of elephant 1 – TEVA, I will be happy to be break even in September.

How are your options doing?

Wow! Awesome job for the month of August. Even with those elephants you managed a pretty nice return between options and dividends. I’d still keep that dividend stock. If it continues to pay, the dividend is safe, why not just hold on. You seem to be making most of the income via options and have been very good with most of your trades. Keep up the good work.

LikeLike

Too many elephants right now with me, AH is a big one here, but also VPK. I’m rolling too, but have not found out what the best way is to keep rolling (time, or strike or both). Not liking it right now, but that goes with the territory of a new trading opportunity. Not making much money at the moment.

You are doing rather well despite your elephants! Inspirational 🙂

LikeLike

Ciao ATL,

First of all compliments on the great month!It’s a great feeling when you beat records, so I am sure that you feel quite elated too! 🙂

Going to the pending questions, I would not sell a stock that went up 50% in 14 months, but I do not know which stock that is, so it’s hard to give a more precise opinion (for what my opinion is worth…). Optionwise I use the same strategy with SOME options, I set a buy order for usually 50% of the premium value, and forget about it. Then if the option hit it I am out of the trade. Sometimes I set the value less than 50% depends on how long the option is. I do not care if the 60% means 10 dollars profit, big fortunes are made of little steps, the important is that the AROI component is higher or equal to the starting one, exiting a trade allows me to start other trades earlier.

On the bad options if you can roll not at a loss of course it’s the best move, sometimes I roll into strangles and even inverted strangles to keep profit, clearly this increases the exposure on a trade but allows me to lower my strikes. I am doing this with my GME BIT:G and FRA:DBK trades, so far I am managing not to lose and move forward not to get assigned.

Ciao ciao

Stal

LikeLike

Thx for the feedback.

Rolling into strangles is a way to defend. It just sounds dangerous to me with short call. It is a mental thing. I might try one.

LikeLike

At first I thought the same, then I started adding straddles and inverted strangles… Of course you have to manage the trade more closely, but it’s a viable option to reduce loss. A strangle it’s “safe” because one leg will never be ITM, the other two are a bit more dangerous, but as I said, totally manageable.

LikeLiked by 1 person

I could always put in a buy order on the stock below the strike of the naked call. That way, I have no risk and can make a small profit on the stock. Does that makes sense?

LikeLike

Yes technically you can do that, but you are increasing exposure to a stock that it’s going against you, if you are positioned with a strangle the most important thing will be checking time value to avoid early assignemnt. I was early assigned calls only near dividend dates on DITM positions, so it’s not an event that occurs all the times. So first check earning dates and dividends then make your move, in this way you can avoid having open positions expring in volatile times…

LikeLike

I would only do this when the stock is getting close to the call strike. This could indicate an uptrend…

LikeLike

Not sure… seems very risky to me. Trying to predict the market is not a great exercise, what if the stock tanks? You get the premium from the call and the loss from the long position. If the call strike is “hit” just roll that one, the other leg will be OTM and you will close it for little cost or even 0. When I do strangles now as soon as one leg hits the strike I roll it to the higher possible strike for profit, I do not wait anymore like before, so it doesn’t get ITM. Most of the time the stock goes below the original strike in the short term, but I do not care, it’s safer that way.

LikeLike

Good Point

I just have a bad experience with rolling calls

LikeLike

AD will sort itself out. A few quarters where they continue reporting the same profit numbers and the market will get over its scare of amazon.

For the other elephants. Is there a reasonable possibility you will be able to roll your way out of it? If so keep rolling, if not take the loss and move on to greener pastures …

LikeLike

Impressive annualized return, ATL! You may have a couple elephants but that means you’ve gotten many more picks right. I’ve followed the drama at Teva fairly closely, boy has that been a mess lately! Hopefully management can get it turned around.

LikeLike

Fingers crossed on TEVA… I took already a 500usd loss…

LikeLike

Congrats on the great month even with the few elephants. At least it sounds like you have a good handle on them now moving forward. Can’t be a winner every time, it happens. But at least you are still making good profit.

LikeLike

CONGRATS! It’s great to see more of us pulling in more money in options. Premiums have been scarce lately. I had a decent month too, $635 in options income. I have a few contracts coming due in October and November. I’d say that they are baby elephants now, but things aren’t going my way right now.

LikeLike

There are ups and downs when trading and investing. This period is valuable as a lesson for my future trading.

LikeLike

Whow, what a nice Option Income. Wonderful to know that the passive income generating system also works on holidays.

LikeLiked by 1 person

Hi Ambertree. I enjoy reading your blog and am quite fascinated by your dual investing approach comprising both dividend growth and option trading. I have to say that I’m quite impressed by your results on the option selling side. I have considered applying this strategy myself as well, but in my conceptual thinking process I always stumbled upon the following dilemma which kind of deterred me from proceeding further. Conceptually I see the following structural issue (..maybe I’m wrong..): so the idea is that one initiates the strategy by selling puts on stock (one doesn’t mind owning) and upon expiration (or before) one either gets a) stock assigned b) put expires worthless or c) one applies some “repair” strategy where you roll down/forward the put at either a credit or debit. If assigned, the strategy then moves into call selling territory (assuming the stock price did not move significantly below the strike price of the put assigned – to break even if assigned on the call), whilst also receiving dividends during stock ownership. in all other cases one continues collecting put premia, which magnitude depends on the how the price has moved (if previous put was ITM the subsequent roll-over may not yield the same amount of premium). The aforementioned concept is clear, but the way I see it the strategy has an inherent flaw. De facto, the underlying stock price can either go down, remain flat or go up. When it goes down, the subsequent put premia to be received will gradually diminish and in fact if one applies the roll-forward tactic, the frequency of new premia becomes less.. worst case scenario you get assigned and theoretically you can then switch to call selling and receiving dividend..but the amount of call premium available may be quite disappointing if the stock has gone down a lot below the price the stock was assigned to you..so then for a certain pint in time your only income is minimized to dividend income.. when the stock price remains flat the strategy works at its best, but if you look at any historical performance of any random stock, you will not find prolonged periods of flatness.. so that leaves the last scenario of prices going up.. normally this is a good scenario as you get to keep the put premium.. but what a lot of investors – I think – underestimate/neglect is that in order for you to initiate another put position on the same stock you also need more cash to secure the put (ie if stock goes from 50 to 60 you need 6k vs 5k to secure the put obligation).. so as an income strategy (using the proceeds to fund expenses for example) it may not work so well as in a rising market the profits you made (ie premia received) have to be redeployed to bear the increased cost of selling puts (cash secured).. but even if we neglect the latter point.. let’s assume you continue to collect the put premia for 2-3 years riding a nice bull market.. at one point in time the market will turn and unless you have perfect market-timing capabilities you will most likely get assigned at one point in time at – historically speaking – high levels (near top of the bull market)..coming back to the scenario of falling prices you may then end up holding stock which only provide dividends in the event that call premia are not worthwhile (unless you risk selling calls at strikes below your break-even)..

based on the above, I conclude that this option selling strategy hence only proves to be profitable in flat markets..but as I said before, flat markets generally don’t last very long..

what are yur thoughts on this? am I missing something?

Cheers, Jack

LikeLike

just to complement on the rising price scenario: so you most likely get assigned against historically high prices and upon a steady turn in the market you may face a prolonged period of only receiving dividend. What I forgot to mention is that during the build-up in the bull market in my example, your received premia have to be redeployed to increasing margin requirements to fully cash secure the new puts (at higher prices as the underlying stock keeps on rising). De facto, you may see an increase in your net worth, but you will not see any positive cash flow as all has to be redeployed (unless you opt to redeploy into lower priced stock).. my conclusion remains that the strategy may initially show a temporary nice performance, but gradually will show slowly declining performance and a resulting (assigned) stock portfolio at a relatively high cost base.. Save for flat markets, even good performance remains limited to paper profits, not real cash flow.. happy to hear your thoughts on this..

LikeLike

Hey Jack,

Thx for the comment. It is an interesting read. I do understand your concern of getting assigned stock at historically high prices. My thoughts on this are the following:

1- you can always buy back the put for a loss and avoid assignment. When doing this, off course, you loose money. Have a look at Tastytrade: https://www.tastytrade.com/tt/shows/market-measures/episodes/sell-puts-or-buy-stock-05-24-2016 or http://tastytradenetwork.squarespace.com/tt/blog/active-vs-passive-investing. You will find much more info on their site.

2- When the markets go up, there are often stocks that are going down or stay flat. A stock can miss an earning and go down while the markets goes up. That can then be an interesting stock to sell puts on.The same is true for sub segments in the market.

3- You can also diversify with uncorrelated assets: Gold, oil, stock have a correlation that is not one. This also gives opportunities to diversify away from a market correction.

As I only trade options since the summer of 2015, I have not yet seen a correction like 2008. Hence, I have a biased view on the situation.

LikeLike

Hi Ambertree, yes i can see that one some exit / mitigation strategies as you mention..

But if i look at option 1 & 2 (respectively buy back put and reinitiate selling puts on stocks that go down/remain flat during bull market) then one implicitly had to accept that one has some superior madket timing capabilities.. buying back the put means indeed as you say taking the loss.. but one would only do that if one is convinced that the price continues its fall (right?).. moving capital to falling/stable stock (option 2) also requires the dirrction of those stocks to go as you predict/bet on.. so de facto it remains a very directional strategy.. if you bet on direction, probably a long position yields higher returns?

In risk- reward terms, selling options translates into assymetric returns (limited upside, disproportionate downside).. when the market does not move in direction to make your position profitable, you most likely end up with only receiving dividends on relatively subpar cost basis with limited upside potential..

LikeLike

Another – more simplistic – way i look at this is as follows:

Currently, 1 month ATM put options on the usual suspects (blue chip dividend paying stocks) yield about ~1% of the strike price (which is de facto your required capital strike x 100) .. Best case scenario this results in ~ 12% per annum, assuming 12 consecutive rounds of 1month ATM put selling.. During this time you don’t receive dividends (assuming you never get assigned the stock).. If there is however one or more months of a setback in the price of the stock upon expiration uring that year, you may not be able to attain the assumed 1% yield on either 1M ATM put or Call option (if you get assigned stock)..

So your expected range of returns is [MIN dividend yield – MAX 12%].. With an associated risk profile roughly equal to long stock position.. The long stock position would yield at the minimum the dividend yield (~3-4%) so one would only need ~8-9% of price appreciation vs cost price to equal expected return on cash secure put variant.. The latter however only yields ~12% if stock remains flat or continuously rises.. If the stock remains flat then indeed cash secured put could prove to be superior.. But if stock rises any price appreciation beyond 8-9% would result in superior performance of the long stock position.. So i come back to my initial fear that cash secured puts only -comparatively – makes sense if one expects flat price behavior of the stock in question..

Note: the assumed 1% 1M ATM premium vs strike may not hold when volatility rises (currently we face very low VIX).. But volatility generally only rises when stock prices drop like pigeon’s shit.. In the latter event, the cash secured put strategy will make you end up with endless roll-overs or assigned stock with limited call selling potential ..leaving only the dividend ..

LikeLike

Hey Jack,

VIX is indeed a big driver of the options premium. It measures the total market. My strategy does not write puts on the total market. I select sub markets and individual stock.In these, you can find premiums ATM that are higher. (Look up the tastytrade research on this: the put writing out performed the index when looking from 2005 till 2016 – time of the study)

Secondly, I do rarely write ATM puts. I prefer to go with OTM puts. This way, I have some space to be wrong. It means that the stock can go down and the put can still be profitable. example: stock trades at 50, Write the 48 put. Stock is at expiration at 48,5. You still get the full profit and now can write the put at 46. This is a counter example of where you can get premium in markets that go down in a modest way.

When assigned, you get the stock at the strike – premium: you have thus extra protection.

You mention that buy and hold would only need 8-9 pct stock appreciation to beat put writing. That does not look like much. Just remember that the long term total return (dividend + appreciation) is only 9pct. Recent years (2011 onwards, it has been a lot higher). There have been periods (1970ies) that the market was flat during a decade.

I try to avoid market timing as this is not possible in my opinion. In stead, I look at stock that go down. As a result, the option premium should go up. This could be a good opportunity to sell a put. Off course, you should investigate if there is news or any other reason for the stock to go down when the markets are up. And I am not sure to sell the put at the bottom. With OTM puts, this is not needed, I have extra build in protection.

LikeLike