May has been a great month. Plenty of public holidays with good and great weather, time with family and friends and a party for the 40th birthday of my wife. What else would you want? And then I looked at my total passive income. It is just amazing to cross the 1000€ mark in a given month!

Let us start slow, and build up gradually to the final result.

Dividends – 23,98€

May has been a bad month compared to last year: a 62 pct drop. Not a reason to smile. Just be aware that dividends are actually an accidental income, part of my play money. I do not focus on this. The drop is caused by the sell of an investment that pays in May.

Capital gains – 321,7€

May has seen a massive capital gains income. This is all the result of 1 covered call: my RDS.A shares have been called away. No real reason to be sad. I will write put options at strike 24 until I am assigned stock again. When that happens, the put premium will have outpaced the missed dividend payments.

By design of my trading strategy, these capital gains are more a one off thing that happen exceptionally.

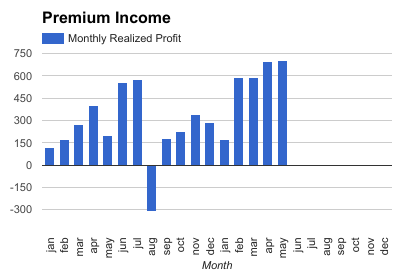

Option income – 704,17

A new monthly high! and this for the 5th month in a row this year. WOOT WOOT!

Part of this is due to the fact that I added more capital to the options portfolio (the cash of my RDS.A sales and some left over cash in a given trading account). As far as trading goes, I stay roughly 90pct of the time loyal to my strategy and plan. I dare to do a gamble trade once in a while. Some go good, others will take time to recover.

As mentioned before, I need to think about setting up trade diversification as well. Right now, when the market will crash, I will take a major hit and end up with a lot of stock. During that time, it is very unlikely that I will be able to sell puts, and it will take time before I can sell covered calls. My income will thus drop. Will I be ready for that to happen? It is not something to look forward to.

Current use of leverage: for each 100€ in option contract exposure, I have 60€ cash.

Current annualised return: 15,4 pct (this is after all trading fees and applicable taxes). Imagine that this continues… would be insane… More realistic is 10 pct.

Total – 1049,85€

Seeing this number makes me pinch my arm. Is this real? IT is beyond my wildest dreams!

I do realise that roughly 30pct of this is exceptional. The capital gains are in general not there. Crossing that mark is thus more a gimmick than a result I can expect every month.

How was your monthly income?

Holy cow!!! That’s some serious option income for the month. Congrats! In all, hitting four digits in any month is a great achievement even if you consider your dividends as “accidental income.” Keep doing what you’re doing.

LikeLike

thx for the support. I do like the dividend income that comes from time to time

LikeLike

Darn mate, that is a lot of money and one very good yield! Well done. I’m certainly not as leveraged on the options trading as you are, I stall have a lot to learn 🙂

LikeLike

I started with baby steps and increased from there… I am still curious to see how a 2008 scenario will affect me

LikeLike

That is a really nice threshold to cross, even if its only for one month 🙂 Its great to see that you aare getting such good results with the option trading. Maybe someday in the future I will have a look at that as well. I just posted my results for may as well. Peanuts compared to yours ofcourse but no less fun!

LikeLike

Congrats on crossing the 1.000 euro mark!

This month was slow investment wise, with work and all 😉 I only did the one put on ADM. The way of the sloth was strong this month. Perhaps I will finally achieve enlightenment in June and do 0 trades ..

LikeLike

go sloth, go… OR is that too active as encouragement?

LikeLiked by 1 person

Congratulations on a great month. Premium income grows nicely!

LikeLike

no complaints so far. I think I can get stable at 600/month as baseline

LikeLiked by 1 person

Wow 70% of your passive income came from options!!! That’s incredible. It looks like you are doing really well in this area. I definitely need to look further into options. I haven’t played them since the mid 2000s when volatility was crazy. But now might be a good time to play again. Thanks for sharing!!!

LikeLike

keep us updated when you start to use options again. I like to read these stories

LikeLiked by 1 person

Wow :O Good job 😀

LikeLike

When the system starts to work… 🙂

LikeLike

congratulations !! Crossing the 1k mark is always a great feeling. Still learning the options as you know, I hope to get where you are one day to supplement my dividend income.

PS. Your blog post loads fine in the North of China :-))

LikeLike

Great feeling indeed. I hope it happens again somewhere this year… Would be great. IT requires all the starts to be aligned…

North of China… great place to be. e have been there for a short 2 week trip. Great experience

LikeLike

Congrats on a new record month and options income! Those are some serious numbers. Seems like adding more into your options account has been paying off for you. Keep up the good work!

LikeLike

thx for the support. The real boost came from loosing my RDS.A.

LikeLike

Nice achievement, amazing how the option income remains so steady.

LikeLike

So far, the experience is positive. I get used to the system and effort needed to trade

LikeLike

Well done Amber Tree! I love seeing the progress that you’re making and you’re killing the options income. Keep doing what you’re doing and you will keep winning 🙂

Mr DDU

LikeLike

Nothing more to say than CONGRATS! The results were great this month. I do think the income diversification is a great idea and something worth looking into. Option income can come and go, but you are ON FIRE right now!

Bert

LikeLike

That’s some awesome options income. Do you just sell puts and hope the market stays up?

LikeLike

Yes, otm Puts on stock I would not mind to own.

LikeLike

Congrats on passing four-digits. I’m no where near that in passive income. My current passive income for all of 2017 is presently $187, so I have a ways to go. It’s good that your income is diversified and is not just coming from stocks. I’m actually interested in the covered call strategy myself, but wanted to learn more about it before I dive in.

Anyway, congrats again. Very impressive.

LikeLike

Thx. This was an exceptional event where all 3 ligned up quite well.

When you start, look at the progress and lessons you learn. The results will follow.

Feel free to ask questions on options.

LikeLike

Wow looks like you are doing great! I’m just beginning my journey for passive income it’s great to see success stories! I’ll be following to see how you continue to do.

LikeLike