Right now, I enjoy the green green grass on my option trading prairie… The results YTD just blow me away. I have never imagined making this kind of money from options. I do know that I need to keep my feet on the ground. Bad times will come. Hence, I work on my risk management and reporting tools all the time.

Options Income

In April, I made 694,23€ in realized P&L. This is the amount of money that I made from selling options and buying them back. It is the net profit after trading fees and taxes.

In April, a total of 13 stock/ETF are part of my profit generating machine. When i look back, I have added a few new names to my list of candidates.

Having a long list of inspiration for trades is important. Not all stock move all the time in the same direction. With a long enough list, there comes along regularly an opportunity.

The mont of May will be a more challenging one, for multiple reasons

- I keep my powder dry in the run towards the french election. Trump could not win. Le pen can not win either… It might create trading opportunities or hit me hard…

- Too many ITM positions for the moment. And the ex-dividend date on these positions is only a few weeks away… When I get a assigned the stock, I block a lot of my capital in these names.

Dividend Income

None… In May/June some dividend should hit my account again.

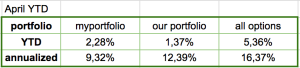

YTD annualized results

Recently, I added a annualized metric to my reporting tool. The results so far are awesome. Keep in mind that a big part is due to the use of Margin or leverage. That means that not all my positions are covered with cash. Do not try this at home, unless you know what you do. For every 100€ risk I take, I have 58€ in cash.

How was your April?

Ciao ATL,

Wow great result there! It’d be nice to see a list of your trades, are they all puts or also some CCs? Still, pretty awesome! 🙂

I didn’t know you traded on margin, almost 50% it’s huge (to my standards), I rarely use margin, prefer to keep things cool at the moment… 😛

Ciao ciao

Stal

LikeLike

Good Idea to show list of trades. Most trades are naked puts, occasionally a CC (I do not own a lot of stock).

One way to manage the margin is the diversification. I have position sin gold and silver related assets. They tend to have negative correlation with stock…

LikeLike

Wow, that was an amazing month of income from your options. You really seem to have the hang of trading these types of investments. Too bad no dividend income to balance things out a bit. It will be interesting to see how May unfolds. I know it shouldn’t matter who wins in France but no matter what the results are a knee jerk reaction up or down should be coming. It’s just the way our markets work these days. Thanks for sharing.

LikeLike

For my long term portfolio, it does not matter who wins. For my options, I trade 45days out. So, it somehow matters a lot!

I also started a new ETF portfolio, that pays dividend as a side effect.

LikeLike

Wow, that is one hell of a good return on investment! I’m just starting off an the left side of your income graph, but no ITM options at the moment. Will need to see how and when I’m going to do new positions. Not sure about the French election…..

LikeLike

We all start small, need to learn, hit a wall then improve… and this life long!

TO counter the FR elections, I did some more US trades. And I might do some defensive consumer tomorrow.

Today markets are closed and we go for a hike…

LikeLike

Was hoping to do some trading today after 2 weeks of holidays….totally forgot about May 1!

LikeLike

You can always study some stock to be ready for tomorrow.

LikeLike

I’m ahead of you on that one 😉

LikeLiked by 1 person

Cool…

LikeLike

Impressive returns! Clearly you’re getting the hang of it 😉

We hold to few positions to trade options with, besides it’s not our main focus to get income from. We migth experiment with it in the future, but that’s still years away probably. Still interests me in how it works, a list of trades will def give a nice view behind the scenes, like Stalflare mentioned.

LikeLike

thx for the feedback. i am curious to learn what you do. I will consider the list of trades

LikeLiked by 1 person

Very nice income. The longer I do this, the more I realize there is always a profitable trade to be found somewhere. With 13 stocks/ETFs you should always make some money somewhere …

LikeLike

yeps… My watch list is about 25 (and growing), it is diversified between defensive, tech, gold, oil… usually, there is always one on the move.

And do not forget crowdsourcing….other bloggers follow a lot of stock and report often on dips that create a buy opportunity. For me, that is often a STO for a put case.

LikeLiked by 1 person

Impressive options income for the month. Glad that is coming in to offset the no dividends in the month. Just makes it even better when they both provide income for you in the same month. Cheers.

LikeLike

Dividend income is not really my focus. It is rather a byproduct of my strategies: options, play money and ETFs (when accumulating not available)

LikeLike

Well done ATL, I made $5,591 in April. Sounds unbelievable, these options were issued in Dec and January but either expired worthless in April or bought back in April. Add in the other three months, I made a total of $17,754 for 2017 which would be outstanding if my portfolio value was $100,000 (17.5% return) or $200,000 (8.75% return).

My point; sharing my option income amount maybe encouraging but isn’t very meaningful without the size of my portfolio, option time frame or the amount available margin.

Agree or disagree?

LikeLike

Good point. There needs to be context around the reurns. I had similar thoughts and a comment on another site. that is why I added the Annualized return and the level of margin. With a little bit of math, you can guesstimate the size of the portfolio. Should I be more explicit?

LikeLike

Sorry if I sound critical. Just questioning your table of figures, YTD of 2.28% (my portfolio) is for 4 months which turns into an annualized return of 6.84%, not 9.32% or am I misreading your table?

LikeLike

Do not hold back your feedback.

I need to clarify that table… The portfolios did not start on Jan 1st. One was started in Feb and another in March. That explains the difference. I will do an update next week, including risk I take, trades, formulas used,…

LikeLike

Very nice results, good for you! I do not check my investment return on a monthly basis, so I am not sure how I did…

LikeLike

I check my Long term portfolio on a monthly basis to have the graph. Options is a daily hobby…!

LikeLike

Woow that is impressive. That is definitely more than my monthly dividend income goal. How much capital would I need to start options trading ? It’s definitely something I want to get started soon. Keep the numbers growing

LikeLike

Nice to see your update ATL! Funny to see more people doing some options trading. I’m still learning the DGI ropes so maybe in the future…

LikeLike