As a family, we are far away from FI. The current official retirement age in Belgium is 67. That translates for me into 2043. Every year that I can be free before that is a win! So, what is the current guesstimate?

When I first made a calculated guess of the FI date, I came to 2029. Not too bad, that is a full 14 years sooner than the current regular people.

After a year of blogging, meeting people, changing jobs and getting new insights, it is time to update this guesstimate.

It hurts

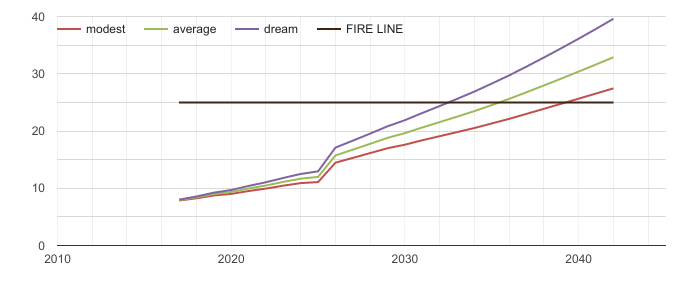

Plugging all the numbers in my custom, personal simulator, I have nice graph with the following result.

Compared to my previous plan, I now end in the year 2040! This means I have lost 11 years compared to a year ago.

Big fail?

Let’s analyse before we jump to conclusions.

- After 2016, I did a full review of our real expenses. As we decided that travel experience is important to us, we needed to adjust the budget. When we want to ski once per year, have 2 weeks of summer holiday and a few weekends away, then we need a lot of money. Before 2016, we did not ski and stayed local for the holidays. Big impact on the budget. There are off course alternatives:

- No travel: ain’t gonna happen. We do want to enjoy life

- local travel: summer weather is just not reliable enough. Last 2 years, we shortened our summer holiday due to rain. Big bummer. We off course arranged alternatives, it is just something we want to avoid

- No ski, no way. I love the outdoor activities, the atmosphere in mountain towns, the scenery, the speed you get

- Job change: in 2016, I joined a startup for a lower salary. In exchange, I got what I consider a more comfortable work environment. I refrain now from statements like: I hate my cubicle job, I will never keep doing this till retirement. For me this is a BIG WIN! at least, I do something I do not mind doing. in a certain way, that means I am free. As a result, there is less money available to invest. What are the alternatives?

- return to mega corporate and golden handcuffs? I am not that kinky

- take a side hustle: that would mean less time with family and friends.

- Taking unpaid leave at work. This means I get a lot more holiday throughout the year. Time I can spend with the family, friends, on road trips,… Worth all the money. The impact on a FI plan is that there is less money coming in.

- The updated version of the tool now has inflation build in. It is scary to see how expenses rise with inflation… that added a few years as well.

Big Win!

Despite the later FI date, it still feels like a win. I actually get to live already in 2107 a life that comes close to my ideal life. That is worth a lot. This is how I phrased it before

Work about 9 months per year on challenging projects and deliver results. The remaining 3 months are spend traveling, if the school agenda allows it. My work should allow to have each day either the morning or the evening to be there for the kids and weekends should be for family and friends. Over time, I would go to less work. The free time could be used to work on other challenges like volunteer work or more social related challenges.

Other than that, there is more in Life than FI! Happiness comes from a lot of things. And the good news, these items are now part of the plan. In 2017 already, not as of 2019!

What are the flaws and upside in the model?

- The model assumes no salary increase what so ever. That is a worst case scenario. As I can not look into the future, I prefer to keep it like this. When the current job goes well, there will be increases. When the current jobs comes to an end, I will look for other, -hopefully better paid – opportunities.

- I do everything based on the modest scenario. This suggest modest returns per year. Why? With the current valuations in the market, there is a consensus that the next 10-15 years, it is more realistic to have lower returns that the average overall long-term results. Current CAPE is above average, thus expected returns are below average.

- Option income is not yet part of this model. Last year it accounted for 3K. Quite an impact when you ask me. Is it sustainable? No idea

- The model assumes no income at all in FI. That is not very likely. I expect to keep working and earning when FI. And I expect to get a pension as from age 67. Maybe not a lot. Image we each get only 500€ a month, that would be 1000€ together and represent 300K less we need for FI after age 67. Amazing….

- It assume the 4 pct rule. we know from ERN that this might not be the best pct to pick.

Conclusion

As long as I have a system in place that pushes me in the direction of happiness, than I am happy already now. Interim goals in the process are just that: interim goals!

Life will throw curve balls, life will surprise you. You can not model this.

You can create the habits so that you know that you do what you can do.

We are still far away from FI, right now, I have a plan in place and an adjusted FI date. To be honest, I do expect a lot of parameters to change the coming years. Also, our view on FI might change. What if we decide in a few years to work only 9 months? In that case, we will never FI, we would have reached our ideal life though…

•The model assumes no income at all in FI

Dump this! When I first calculated the amount for full FI I too was shocked of both the amount or time it would take to get there. But I have come to realize that the full FI way is too heavy influenced by the USA social system. The Belgian social system does not work well for a full FI scenario but it does work great for partial FI!!

Embrace it!! Even just adding 3 months work at 1.500 euro a month takes a big chunk out the amount necessary. And three months is nothing! My hope is to be able to do this with passion projects but if they turn out to not make a euro I am more than willing to go work a mind numbing job (security was my fall back plan) for three months if it means moving the FI date for the other 9 months of the year up with a decade!

Remove this point form your model and rework it completely! ‘No income at all in FI’ does not work well for Belgium, I have already told you this … Ok, that’s it, I am getting my hammer …

LikeLike

Message understood! This is more a theoretical exercise… My dream scenario is to work up to 6 months on interesting projects. And as long as the kids are in highschool, i will be happy when i have holiday when they have. With that as entry point, i might be there in max 8 years, the year when the mortgage is gone!

LikeLike

Good for you! That is exactly the way I look at FI. It is much more about happiness and a different view on work and life than it is about suffering now in a cubicle to be able to do noting anymore from date X.

LikeLike

Like you said, a delay is well worth it if you’re living a good life now. Sounds like the career change is working well for you so far. You’ve got some conservative assumptions baked in here (no income in FI, no salary increases, etc.), so I suspect you’ll get there far sooner anyway.

LikeLike

Did you consider working 75% and in the rest of the time building up a small online business or sidehustle with passive income potential?

LikeLike

I agree that when you retire is not that important as long as you enjoy life and your job. Another option would be to own your own business instead of working for someone else.

LikeLike

Sounds to me that the target date of FI isn’t the real goal here… I really resonate with the feeling that you don’t want to ‘wait’ for a fulfilling life. But make consistent choices to be able to live the life you want, right now. So what if the date moves up? It can easily move again, but then to your advantage!

We also have a target date but know that it’s not set in stone. We just try to do our best to get there (or the life we aim for) as soon as possible.

LikeLike

This sounds amazing! I too have been wrestling with the same questions/scenarios before you made the moves. I am not there yet for the job change and so on yet since we just had a kid. My wife and I decided to reexamine everything again at the beginning of 2018. This article really helps me out with how other people are looking at the same questions so thank you for this post! I look forward to more updates in the future!

– Adam

LikeLike

In my experience, time will tell you when you are ready for a job move. I first moved from golden, diamond plated handcuffs to golfen ones, and then to no handcuffs at all. It helped to understand my numbers and my intrinsic motivations related to work.

LikeLike

It’s all about being happy! It would be great if you could become FI sooner, but why rush if you are enjoying life?

LikeLike

Happiness is the main goal, everything is there to support that. Partial FI is now the new item to investigate. Kinda like: what if in a given year our SR is exactly 0 because we travelled really a lot?!?

LikeLike

That would be a sweet year!

LikeLiked by 1 person

I struggle with the changing of the jobs as I recently looked into another job, or at least thought about it, and came to the conclusion that even though I hate cubicle farms, I like the pay. It’s really hard for me to turn away from a six figure pay with a 13% retirement benefit package (8% 401k and 5% pension) if I truly want to hit FI early. Congrats on taking the leap though, I struggle with it myself and applaud those who are able to do so early. I think I’m more willing when I am closer to FI and have a larger asset base.

LikeLike

I think that this sounds great, and we do change our minds as we go through life, which is fine! If you have a good job and are in no rush to leave it, then stick with it. 🙂 Keep saving, keep hustling and you will achieve your goals!

LikeLike

thx for confirming my thoughts. I might use this situation to have some extra time with the kids and wife during the holidays

LikeLike

Very interesting post ATL!

I think that you have reached something most people don’t in their entire life: a balance where you get to live NOW and still have a retirement plan. Time spent with your family NOW will never happen again. My oldest son is turning 12 and I can already see him growing as a young adult.

If you really want to reach FI sooner, spend your time and energy on creating a passive income side hustle. You will work hard at first, and then, the money will come without much effort. Before I left for 1 year to travel, I’ve spent 18 months working nights (from 10pm to 2am) 3-4 times a week. I kept my time with my children and my wife and I only cut hours of sleep. Not the end of the world to realise your dream, right?

I’m curious, what is your rate of return assumption on your portfolio?

Cheers,

Mike

LikeLike

This is definitely something that I struggle with. How do you live for today while saving for tomorrow. I want to enjoy the financial journey and not live in a shoebox eating ramen. That to me is not fun. So some of our FI goals might change over time but we’ll see 🙂 Thanks for sharing!!!

LikeLiked by 1 person

Finding that balance is a journey on its own!

LikeLiked by 1 person

Hi amber — Mustard Seed Money just wrote on this as well so I hope you don’t mind if I cut and paste my comment … bottom line is that I agree with you. The goal is not just retirement, it’s freedom and happiness, and if you can find that in the present then you’ve found a key to life! From my MSM comment:

Like you, we want to spend money on memories and travel rather than stuff. And we wanted to start traveling with our kids while they were young — it’s such a unique stage of life and it’s a joy to see them experience the world. It’s not easy but gets a lot easier around age 4-5 when they are out of diapers and have more stamina, and now this is part of their lives. They embrace the idea of being world travelers. I love it.

But yes, this is a trade off and a deliberate decision to spend rather than save. We don’t really enjoy traveling on the cheap, and we insist on paying for a hotel suite or for 2 rooms so the kids won’t drive us bonkers. And we like room service and a pool. It’s all part of the fun. So at some point we needed to decide — do we want to save more now and travel later, or do we want this to be part of our lifestyle? So we’ve made a conscious decision to spend. Some people can retire early AND travel along the way, which is awesome, but we had to choose. And we’re a bit lucky too because we don’t mind work and we are able to take advantage of 5-6 weeks of paid vacation per year + holidays.

I’m not saying people should only live for today, but I am saying people should find the right balance to get what they truly want out of life. It’s a personal decision. Travel won’t suddenly become easier or less expensive when you get older, and I hate to say it but I know plenty of people who say they wish they could travel more … and then BOOM, they are 50-60 years old, less energy, kids are busy, and the glorious years of travel never come.

Just my thoughts, sorry for the long comment! Great article –R

LikeLiked by 1 person

ambertreestays.wordpress.com is still available 😉

LikeLiked by 1 person

Hi there, this is something I wrestle with too. We love our yearly holiday as well as trips abroad to see the in-laws which we make into a full holiday experience. We always seem to blow our budgets! We have small kids, this year we have decided to go to a camping park (mobile home not tent) with kids – it turns out to be significantly cheaper, with everything on your doorstep for the kids.

LikeLike

Nice update. I downloaded the FI-tool too and played around with it. Really cool.

I think what happens also is that as you move forward, life will throw you some tailwinds or headwinds. So who nows how soon or not you reach FI. But, you’ll reach FI and that is already a great feat. As FFS said, the system in Belgium is set up for you to reach age of retirement and than get a pension. Getting to FI and being self sufficient, no matter what age it is at, is a big WIN in my view.

LikeLike

Thx for the feedback. The tool gives a first indication, without needing a lot od details. I like things to be simple.

The Belgium system has indeed a big push to retire at 67. Not having decent investment options in our company pension and tax shielded accounts is a big limiting factor. High taxes also not help. On the other hand, we are less worried about A president that will change the health care act

LikeLike

It sounds like there are a lot of assumptions that go into this calculation that will be difficult to maintain and may not be an accurate depiction of the life you want to have. The way I see it, you may have lost years in FI, but it sounds like you loved the past 12 months and had a darn fun time. Isn’t that what FI is about? You don’t get to retirement and suddenly stop. You enjoy every moment along the way. Which is exactly what you did. In my opinion, big success.

I don’t want this calculation to discourage you or make you think you are doing worse than you are just because of some flawed assumptions. Keep it up and keep on living the life YOU want to do and making the most out of your time here.

Bert

LikeLiked by 1 person

The whole reason to strive for FIRE is to increase happiness. The date is a secondary consideration. If you are able to craft a life of maximum happiness right now, more power to you I say.

LikeLike