December is the month of the holidays and gifts. In Belgium, we celebrate Saint-Nicolas and X-mas. Both have a habit of bringing gifts. Is it pushing my luck to far to add Passive Income to this list?

Option trading

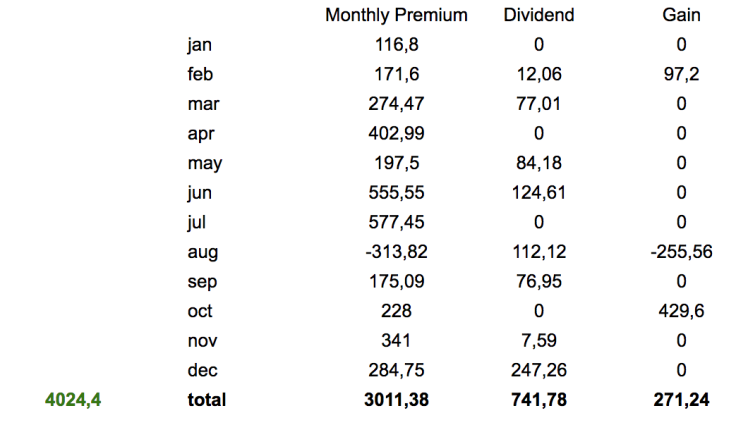

December was an average month for my passive income. I generated 284,75€ of realised net income (after closing the trades and taking trading fees into account).

Fun fact: the last few days of the month generated more trades than expected. You got to love technology… being 2250 meter high in the Swiss Alps, I was able to enter a buy-to-close order that generated 50€ of profit. It paid for a few Glüwhein!

Dividends

December was a nice dividend month: 274,26€. My biggest month so far. This comes from 3 stock that I own: RDSA, SOLV and BPOST. The last one was a buy especially for the dividend. Right after the dividend date, I sold a call to sell right above the entry price. It looks like I will be called away, making a 7% profit on 30 days. I would take that each time.

In total, this means 532€ income in December

Year review

At the start of the year, I decided to launch my play money portfolio. The goal of this portfolio is to channel my need for speed, action and aderenaline on a small part of my portfolio. Basicly, with this portfolio, I can go wild. The idea is to keep the real FIRE portfolio stable, steady and boring: like it should be!

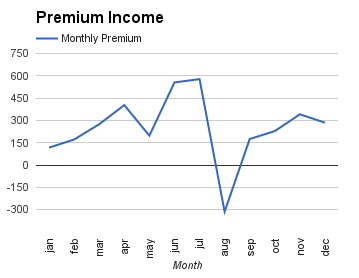

Overall, It has been a good 2016: My playmoney generated in total 4K of extra income. This is composed out of 3K option trading income, 0,75K dividends and 0,25K capital gain on stock.

This includes a 1K loss in August: I thought I had found a working crystel ball… not!

Right now, I also own GDX shares well above the current price. These are not represented here. I only report realized gains and losses. To compensate, I also own KMI shares well above my purchase price. They are not in the list either.

What will 2017 bring? I am especially curious to see what my trading portfolio will do when there is a big correction that lasts moths, or even years…!

Ciao ATL,

Lovely numbers there, considering that this is the “play money”, I see you report closed trades for the options, it’s something I might have to start doing as well, and not just the cash flow like I do now. Still, a very good way to go! Let’s see what 2017 brings and of course happy new year!

Ciaociao

Stal

LikeLike

Improvement I need todo is to reduce the open option position from my Amberindex. I hesitate…

LikeLike

This is some serious cash Mr AT. Nice conclusion for 2016 I’d say.

Well done, now do that again for 2017 😉

LikeLike

Doing this again would-be cool… It pays the ski trip!

LikeLike

That is one heck of a ski trip 😉

LikeLike

That’s a pretty good year of extra income in your play account even considering the loss! Solid work!

LikeLike

Hi abt,

Congrats on a great end to the year – free ski-trips can’t be bad! 🙂

Look forward to seeing the play income increase some more this year.

Best wishes,

-DL

LikeLike

Hey Amber! You and I have very similar approaches. Ironically, I’m also “long” GDX above market (this is where patience plays a role). I also view option trading as “play money”, and money I could lose without ruining my life! Nice annual summary, you do a nice job tracking your numbers!

LikeLike

Patience is a skill I need to train…! I am positive on the outcome

LikeLike

Hello ATL!

there is nothing better than unexpected income to pay for beer 🙂 I love my blogging days where I realize I make more money blogging than what I spend during the same day :-).

I had a very good year on my portfolio too and I hope that it will continue in 2017!

Health & Wealth for the New Year!

Mike

LikeLiked by 1 person

Congrats on a fine year. I really like how your about 50/50 dividend to options income. This is a god way to go. As for technology, I agree with you, it’s awesome. I do a lot of live trading at 38,000 feet. I love it! Best of luck in 2017.

LikeLiked by 1 person

Good job bringing in some awesome dividends Keep it up

LikeLike

Ah, I’m envious that you went to the Swiss Alps. All the good mountain ranges are far from me. 😦

Congrats on your investment income for the year, especially for a play money portfolio!

LikeLike

Hey ATL,

nice results over there!

Keep it up! hope you enjoyed the alps 🙂

best regards

LikeLike

The Alps were great…!

LikeLike

Congrats on hitting your highest dividend income month. That must have felt great in the Alps too 🙂 Looks like you are rocking that monthly income between those options premiums and dividend income. Keep up the good work. Look forward to following you on your ’17 journey. Thanks for sharing.

LikeLike

It does feel good to make money on holiday!

LikeLike

Congrats on December being one of your highest months! It should definitely help with a few of those gifts. Have a great new year!

LikeLike

Congrats on a great month, and what exactly is the difference between St Nicolas and X-Mas? In North America that’s all kinda wrapped up as one and the same.

LikeLike

St Nicolas is celebrated on Dec 6th. He is very present in the streets, shops and commercials. School and scouts celebrate as well. He brings the gifts through the chimey, so the story goes…

X-mas is celebrated more with Family. Prsenets are under the tree

LikeLike

You made some nice option trading profits! I recently sold my first put option on CCE, this way I’ll buy them a bit cheaper (1,5%) or make a 4% profit in 45 days. Definitely gonna look into some option strategies in the soon future.

LikeLike

Keep us posted on the option results!

LikeLike

Nice job ATL, you did a really good job generating some strong investing returns. Well done! 🙂 I hope 2017 is even better for you!

Tristan

LikeLike