A few days ago, I started to question some of my fiscal advantageous investments. What if I could do it better myself? What would you do based on the numbers?

First, some background: In Belgium, we can save up 2260€ in a fiscal the long term savings (LTS) account. This is typically done when you are not eligible for fiscal mortgage deduction. This is the case I am in. As a fiscal advantage, you get a tax return of 30 pct or 678€, so you only spend 1582€ out of pocket for an investing of 2260€. Great deal! Free lunch!

Wait, there is no such thing as a free lunch. What is the catch?

- Your money will be taxed 10pct when you reach the age of 60 (current law). That is on the total amount, after all compounded gains.

- There are hefty penalties when you acces you money before the age of 67.

- It is an insurance product that typically yields just above inflation.

- At entry, you have to pay 2 pct taxes and probably 2pct fee. So, actually, the at-the start tax advantage is only 26pct.

What is the alternative?

As alternative, I could invest myself, each year 2260€ into an investment vehicle of my choice. This means:

- The money is always available, no penalty when withdrawn befor the age of 67.

- There is no capital gain tax (not yet, no idea what the long term fiscal rules might be) and a very small trading tax (0,27%). And do not forget the trading fee.

- No 30 pct fiscal advantage.

- Potential higher yields than inflation. Long term stats are surely support this

Setting up the comparison

As humans are not good in compounding, I set up a spreadsheet to do the math for me.

Yearly investment in the LTS account: 2260, you pay 2pct tax and 2 pct fee and you reinvest the tax benefit back into the market.

This compares to investing yourself the 2260 per year in the market (after trading feed off course)

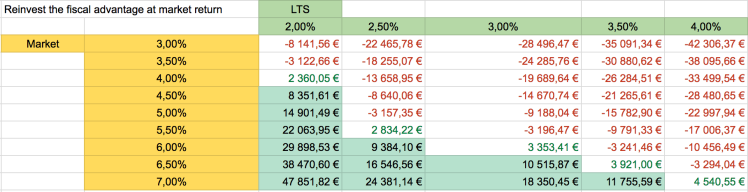

I setup a comparison between different market returns (ranging from 3 to 7pct) and different LTS insurance returns (ranging from 2 pct to 4 pct)

The results

The result somehow surprises me. I expected the do it yourself approach to be far more ahead of the fiscal saving. This is not always the case. The reason is simple: in my model, I reinvest the tax refund in the market as well. Hence, the real difference in performance is on a smaller part (roughly 70pct) and the tax advantage is on 100 pct of the money. That makes a big difference!

As it is hard to look 20 years ahead, Ii is difficult to pick a place in the grid.

For LTS, we can assume that the average for the past 10 years was approx 3pct with a declining trend. The blue line is the market average (source: spaargids.be) The light blue area is the best in class each year. Notice the similarities with the obligation rates.

For LTS, we can assume that the average for the past 10 years was approx 3pct with a declining trend. The blue line is the market average (source: spaargids.be) The light blue area is the best in class each year. Notice the similarities with the obligation rates.

My initial idea was to do it myself. Given the that we are rather to a peak in the market than a low, It is hard to expect long term stock averages of 7pct.

I doubt…

Ciao ATL,

30% tax break is a lot and it’s hard to compensate that with a direct stock investment. In my opinion you are comparing two very different forms of investment, that should not be compared at all. The Belgian Offer is quite compelling, but it’s money you’d better forget about as you cannot take it back. To me freedom of doing whatever I want with my money is essential, but if I had to place a small portion in an investment like that I’d do it, but I will never look into that investment until I am 67… The real question is: can you afford to do that? If there is a sudden necessity how well are you covered at the moment?

Ciao ciao

Stal

LikeLike

You might need to consider both, as some of the money will not be needed until after you turned 67. But you also will need funds to be able to FIRE well before the age of 67 years. A balanced approach may be most useful. Good point about that 7% market return though……

LikeLike

In fact, right now I do both. The fiscal one with the max money, the alternative is my own personal investment with what is left over at the end of the month. Blocking money till age 67 could be an issue. The amount is rather small. The additional point I now see: I would need to invest it at my age of 67…

LikeLike

You are a smart bloke, figures you already had the balanced approach. We do the same with our company provided pension accounts/additional pension options, always diversify and use tax breaks to your advantage!

LikeLike

I’d have to say it’s 50/50. August/September 2015, stock was down 10%. S&P was only down 8%. My account went down 12-15% due to BAC went all the way down to $11/share in February 2016.

Now, my S&P is up 3.86% YTD, my portfolio is up 7% YTD.

There are sectors that are cyclical, last year it was oil and gas companies, this year it’s pharmaceutical companies. Having the flexibility to pick up a few shares of my choice when the sectors is down is great. Of course it doesn’t always work when I catch the falling knife but eventually when they bounce up, it’s a great feeling to be in the positive, like the case of BAC. I average $13/share, now it’s up $17/share. My YOC is 2.3% vs 1.xx%.

WFC was doing so well for the past few years, who knew that behind those great growth number were fraudulent?

It’s 50/50, it’s probably best to leave the portfolio alone and just buy the S&P, but I like the hand on approach, so I opt to do both. LOL 🙂

LikeLike

Hi ABT,

Well you’re trying to predict the unknowable as far as what future stock yields might be, so perhaps it’s a more of a question of what percentage in stocks vs bonds / safer investments you want to hold for the long term, and how much risk you want to take on.

Are there any other tax benefits from with the LTS approach? In the US, similar tax-advantaged schemes reduce taxable income too so you pay less income tax in addition being able to put pre-tax dollars into investments.

Does the DIY approach have any other tax impacts e.g. dividend / distributions that might be taxed?

I don’t know the taxes in Belgium but do be careful when comparing pre and post-tax money though. In the US investing $2,260 post tax means that you needed to earn $3013, so it’s more equal to compare a $2,260 pre-tax amount with a $1,695 post-tax amount (assuming a 25% income tax).

It’s great that you’re doing a detailed analysis on the pros / cons!

Best wishes,

-DL

LikeLike

Thx for the feedback.

In the Belgium case, it is sadly after tax Euros….

By doing the analysis, I try to get a feeling of what would be doable approach. I found out that starting this at age 55 is a no brainer. The tax advantage is so big that the markets would need a high average….

LikeLike

These are interesting comparisons. The immediate tax break is useful, but the compound return is reasonably low …yet it’s very low risk. I suppose it would be another sleep well fund…We have something similar in Australia whereby you can contribute $1000AUD to your retirement fund and the government kicks in $500AUD, provided your income is below a certain threshold. This 50% return is attractive, but the downside is no access to the funds until retirement.

LikeLike

If I understand your situation correctly, we are faced with a similar thing, but as WFT says – Australians don’t have access to that money until around 60 (at the moment). We would prefer to keep as much out of that system as possible 🙂

Tristan

LikeLike