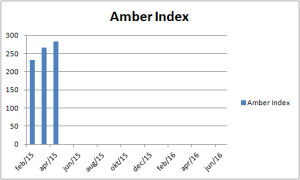

This is the first of regular updates on the progress of our networth. As I am not sure that on the internet I can stay Mr Amber Tree forever, my report will be using the amberindex. I plan to keep this index consistent over time, so that progress or regression can be spotted easily.

At the end of April, 2015 the amber index is at 283. Not bad, not bad

My numbers start from february 2015 only. This is the time when I started really to read FIRE blogs on a regular basis and saw the need to track in detail our net worth. Going back in time is not something that is now on my wishlist.

The big increase in the Amber Index is mainly due to a better view on my assets. It took some weeks to figure out what/where/how all was. Now that all of this clear, I expect to show a more realstic progress.

Going forward, I expect more spikes due to the nature of some investments that I have: mainly the branch 21 accounts. They only report once a year the increase in value. I do not find it usefull to try to guess in between the new value that they have.

I also decided not to include the mortgage as I do not include the value of our house either. The reason not to do this, is that in my current life, my house does not generates passive income. I think my net worth shuld be the assets that can work for me while I sleep.

Another category that is excluded for now is the pension saving from our employers. If I include them, I could either use the current value of the savings contract, or I could use the estimated value at retirement age. As this money is basicly locked down til the age of 67, I prefer not to see it now. As my Freedom day approaches, I will take a closer look to see how I could use this bonus in our advantage.

Lastly, I also exclude my emergency fund from this calculation. By doing so, I do not see the emergency fund and thus I am not tempted to use it for investments or other non emergency activity.

Nice index. Just out of curiosity, how did you choose the base for your index. You started the index at 200something, which mist be correlated with something.

LikeLike

Hey Ted,

The base for the index is a random number that I picked. There is no intention to have it correlate to anything at all.

Cheers

LikeLike

AT,

A random number sadly isn’t saying much, but it’s still nice to see the graph trend upward – well done! Maybe you could pick a % of your net worth goal and use that as the base number?

Also, you could adjust your networth based on the TAK21 insurance accounts throughout the year as you effectively know the base interest rate beforehand. It takes some work, but it’ll smooth out the curve. People will start wondering why you have massive spikes at the beginning of th year otherwise.

Cheers,

NMW

LikeLike

NMW,

Thx for the feedback. I will look into replacing the randomness with a more tangible figure so that the readers can follow better my evolution

for the TAK21, I could use a guesstimate . I have some 0pct guaranteed and bonus only TAK21 in my portfolio. I could use a wavenumber to smooth out the shocks.

LikeLike

Hello ATL,

Interesting approach to your reporting, as noted by NMW there is already an upward trend, which is encouraging!

You could also consider normalizing your number and reporting vs you target number, this way it stays personal, but gives your readers a 0-100% range (100% being FIRE). Just a suggestion, good luck on the journey!

LikeLike

Hey fsf, thx for stopping by.

The past weekend i have updated my xls and will now report compared to my target amount. This way, readers will know where I am.

Atl

LikeLike